About us

welcome to Filsom Limited

Mature investment with highly

qualified professionals and sophisticated

infrastructure.

We're a distinctive wealth and investment management firm actively building enduring value for our clients. We actively manage your portfolio to ensure it remains appropriate for the ever-changing conditions in the global economy and financial markets. We have a well-defined investment process, which is fundamental to the service we provide. This process creates a strong yet flexible framework for our investment professionals to work together, sharing ideas and challenging each other’s views. It is constantly evolving and we continue to invest in the resources required to ensure it remains robust. We are into real estate arbitrage, gold mining and car accessories in delight to meet your essential investment needs.

Collaborative

Resilient

Professional

Sustainability principles and ambitions across our business

Our sustainability commitments, principles and ambitions apply across the investments we make as an asset manager and asset owner, and to our own business operations

Our sustainability principles:

We will consider sustainability and ESG factors when determining our corporate strategy and new business initiatives.

We will embed sustainability considerations throughout our business.

We aspire to be a thought leader, to innovate, and to advance understanding of sustainability issues.

We believe in active asset ownership and management which encourages companies to transition towards a sustainable future.

We consider the interests of all our stakeholders and ensure our views on sustainability are consistent with our longterm approach.

We will manage our businesses to the same principles of acting responsibly that we hold our investee companies to account on.

We review our sustainability thinking regularly in order to align with scientific and technological improvements, and changes in the global economy, ethics and consumer preferences.

We aim to use our influence as a global investor and asset owner to drive positive change in sustainability policy and corporate standards.

Our Sustainability Strategy: Underpinned By Constant Evolution And A Long-Term Approach

ESG INTEGRATION

We integrate environmental, social and governance information into our analysis and decision-making across our investment teams and business lines.

STEWARDSHIP

We are active stewards of the entities in which we invest; this goes hand-in-hand with our active investment approach.

CORPORATE RESPONSIBILITY

ESG is ingrained in our business activities through our corporate responsibility program. This includes our Barings Social Impact philanthropic program, as well as our focus on diversity, equity and inclusion across our business.

Our Sustainability Strategy: Governance, Resources and Partnerships:

DEDICATED RESOURCES

Our dedicated resources help develop and deliver our sustainability and ESG strategy, policy, partnerships, research, training and reporting.

INDUSTRY PARTNERS

We are a signatory to the Principles for Responsible Investment, a member of the United Nations Global Compact and Climate Action 100+, and public supporters of the Task Force on Climate-related Financial Disclosures. We work to advance the missions of these industry partnerships.

FORMAL GOVERNANCE

Our Sustainability Committee consists of senior business leaders and is tasked with supporting sustainability strategy execution. Our Sustainability Working Groups focus on long-term strategic projects and regularly meet and report to the Sustainability Committee.

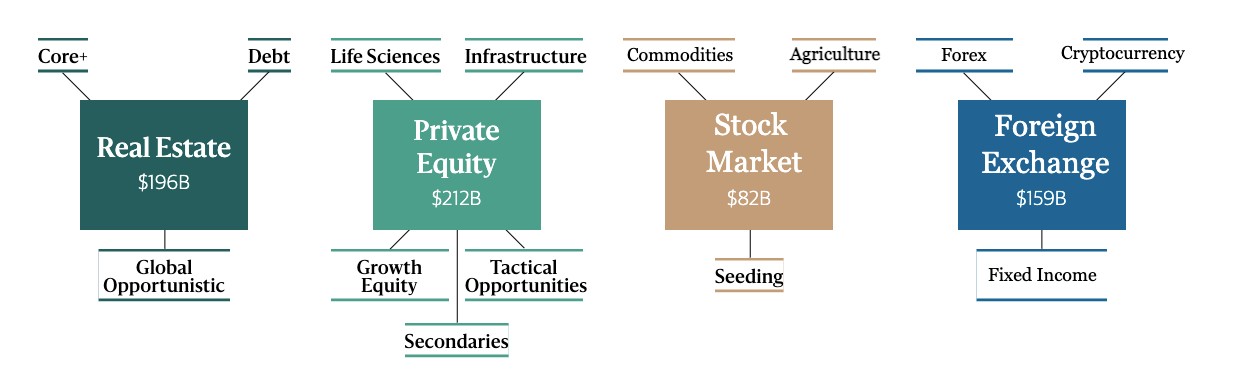

$649B AUM

our benefits

OUR MISSION

Filsom Limited offers an ideal solution for organizations seeking to optimize their financial assets and streamline institutional investment management and regulatory processes. Our comprehensive fiduciary approach to financial and investment management is supported by a proactive team that genuinely grasps your organization's objectives. With Filsom Limited, you can trust that your financial goals will be realized, allowing you to devote more time to your organization's core mission. Explore a unique investment approach that combines tailored asset management solutions with a range of services.